Many small businesses choose to incorporate to experience the various advantages this legal filing can bring, including limited personal liability, enhanced creditworthiness, and tax benefits. For U.S. business owners considering S corporation classification, it is necessary to file Form 2553 with the Internal Revenue Service (IRS) prior to the start of the tax year. S corporation status ensures that the corporation is taxed under subchapter S of Chapter 1 of the Internal Revenue Code (hence, an “S corporation”). This means that the company pays no income tax. Instead, the company’s profits and losses are shared by shareholders. These individuals must report this information on their personal tax returns and be taxed accordingly.

What is Form 2553?

Form 2553 is an S Corp Late Election document that business entities must file with the IRS to elect to pass on tax. Pass-through tax means that the business does not pay tax. Alternatively, the owners/shareholders of the business are taxed on the profits and losses of the business through their personal income tax return. It is important to note that an S corporation is not a “tax-exempt organization”. This classification is reserved for nonprofit organizations designated by Section 501(c) of U.S. federal law, including charities, churches, and veterans groups. In order for a business entity to qualify as an S corporation with respect to its annual taxation, it must file Form 2553 by the 15th day of the 3rd month following the start of its tax year. Typically, a company’s tax year is the same as the calendar year (January to December). However, if a business uses an alternate fiscal year (such as July-June), that fiscal year will be considered its tax year. Therefore, the Form 2553 deadline is not a specific calendar date for all businesses, but is based on their unique tax year.

Why Businesses File Form 2553

The S corporation election has many benefits for growing companies. It can save taxes for businesses such as limited liability companies (LLCs) and their shareholders. The tax status of an S corporation is particularly attractive to owners of a single-member limited liability company (SMLLC) corporation. This entity type provides limited liability benefits for sole proprietorships. When an SMLLC obtains S corporation status, the owners are not considered self-employed, so they are no longer subject to federal self-employment income tax. The tax, which covers Social Security and Medicare, is similar to the payroll tax drawn from the taxable income of employees of traditional businesses. Although filing as such an entity can increase the net income of a single-member LLC owner, it does not completely exempt them from paying FICA and FUTA taxes on their income.

Who can file IRS Form 2553?

Businesses classified as C corporations or LLCs can file Form 2553 S Corp Election and tax treatment. It is important to note that if an LLC chooses S Corporation status, it will still be an LLC from a legal perspective. However, LLCs will be taxed as S corporations at the federal level. Eligible companies must also comply with the following requirements:

- Classified as a domestic business entity in the United States.

- The number of shareholders shall not exceed 100. Each shareholder must agree to the election of an S corporation.

- There are no different classes of stocks. All shareholders must hold the same class of stock. However, different shares can have different voting rights.

- Shareholders must be U.S. citizens, legal residents, or resident aliens. Nonresident aliens cannot own shares in an S corporation. A resident alien is an individual who is not a U.S. citizen and has physically resided in the U.S. for at least 31 days and at least 183 days in the past 3 years. A non-resident alien is not a U.S. citizen, does not have a green card, and does not physically reside in the U.S. as required above.

- Distributors should be people or other approved trustees and buildings. A partnership or partnership (such as LLC) cannot be a distributor.

- Meet eligibility restrictions. Certain types of corporations, such as financial institutions and insurance companies, are not eligible for S corporation tax treatment.

Instructions for Form 2553

Specific instructions for filing Form 2553 are listed on the IRS website. This form is divided into 4 sections for those who elect an S corporation election.

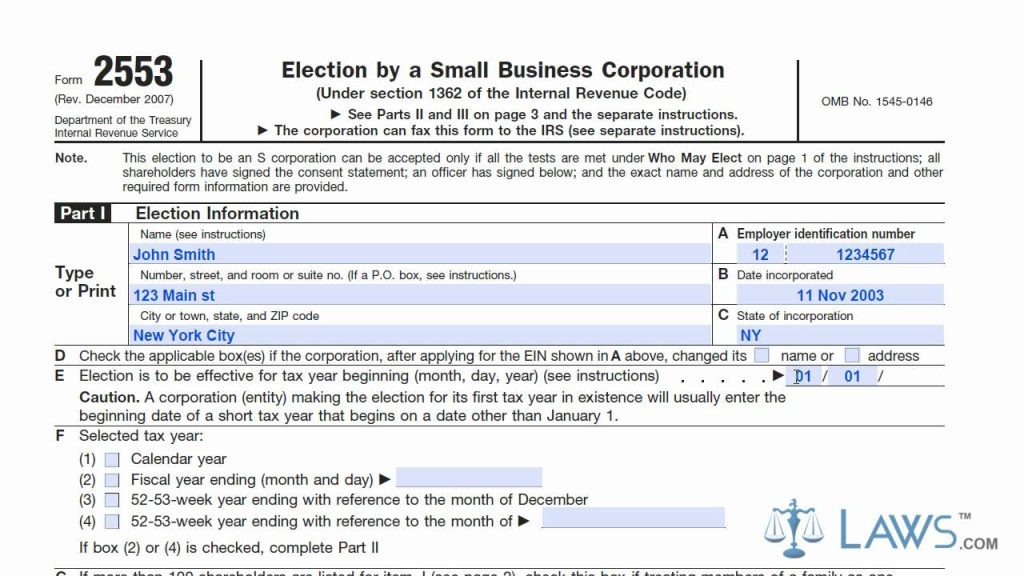

Part 1: Election Information

The initial section of Form 2553 requires identifying information such as business name, address, and employer identification number. Much like a Social Security Number, an Employer Identification Number (also known as an EIN) is a unique set of numbers used to identify an entity for tax purposes and to prove identity.

PART II: CHOICE OF FINANCIAL TAX YEAR

The second part of IRS Form 2553 requires a business to provide information and evidence detailing its tax year if it is not operating in the calendar year for financial reporting purposes. As part of the submission, businesses need to justify their tax year (e.g., product seasonality).

Part 3: Eligible Chapter S Trust Elections

This part of the form pertains to a Qualifying Subchapter S Trust (QSST). A QSST is an estate planning tool that comes into effect when an S corporation shareholder dies and transfers ownership to a single beneficiary trust. If this does not apply to your situation, you can skip this section.

Part 4: Late Corporate Class Election Representative

The last part is only required if you are submitting Form 2553 after the deadline. Late submissions need to be stated in the attachment.